Finance Major: What Can You Do With It?

Setting out on a career in finance is akin to navigating the intricate currents of the global economy. A finance major serves as a compass, guiding individuals through the complexities of financial landscapes. In today’s dynamic job market, where fiscal decisions shape industries, possessing financial acumen is paramount.

A finance major not only imparts the knowledge necessary for deciphering market intricacies but also opens doors to a myriad of career paths where sound financial judgment is the cornerstone of success.

Why Choose a Career in Finance?

Choosing a career in finance isn’t merely a professional choice; it’s a strategic move into a realm of dynamic growth and perpetual demand. Recent statistics underscore a remarkable surge in opportunities within the finance sector, mirroring the expanding global economy.

The appeal extends beyond job abundance to encompass a diverse array of roles, spanning investment, banking, financial planning, and risk management. Finance professionals become navigators of various industries, from technology to healthcare, making this field versatile and dynamic.

Moreover, the potential for substantial earnings and rapid career progression transforms finance into a realm where strategic acumen directly correlates with financial ascent. It’s a compelling journey for those seeking both stability and opportunity.

The financial sector offers not just jobs but career paths that intertwine with the pulse of global markets, creating an ecosystem where one’s financial insights directly impact business decisions and success. With the rapid evolution of fintech and the increasing complexity of financial markets, the need for skilled finance professionals is on the rise, making this career path both challenging and rewarding for those ready to embark on it.

Comprehensive List of Finance Careers

Choosing finance as the field you wish to pursue is never a bad idea. Being competent in this financially-reliant world puts you in good footing on the professional scene. With that being said, here are 10 finance careers that are booming today:

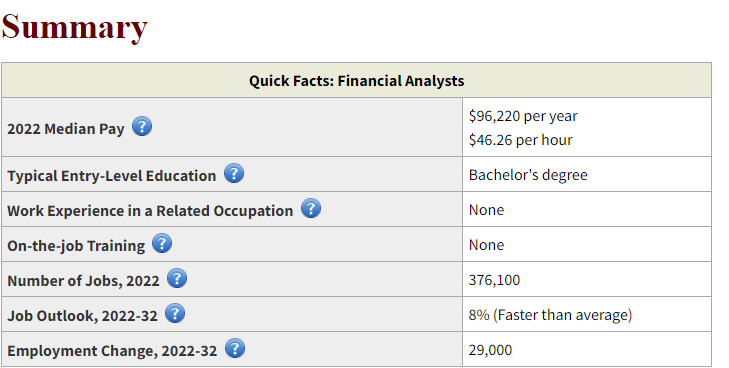

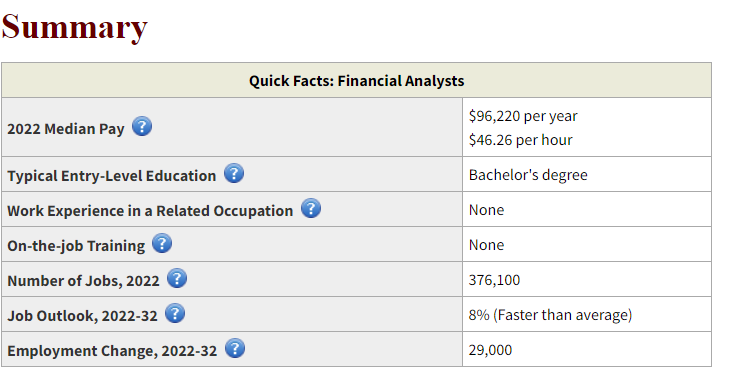

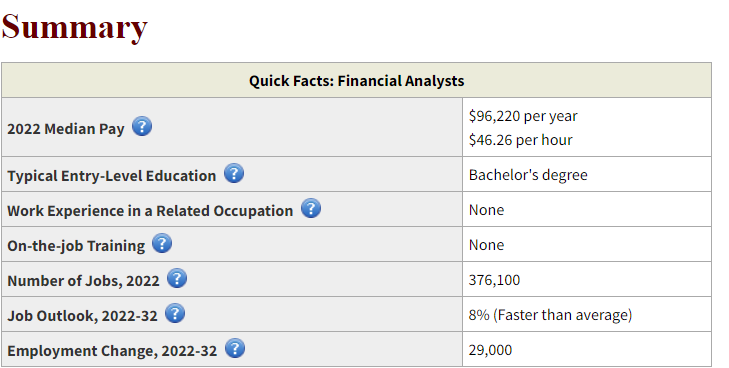

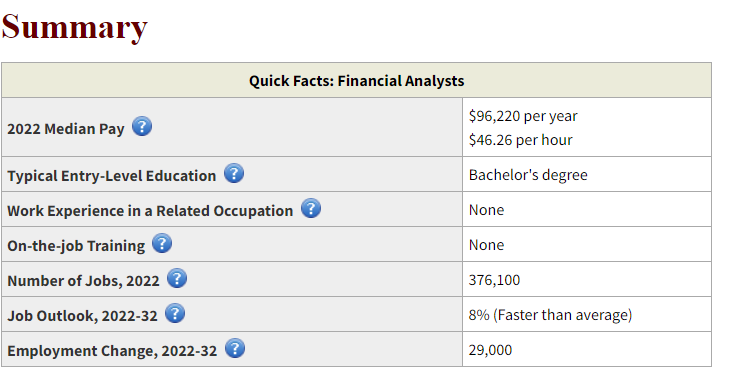

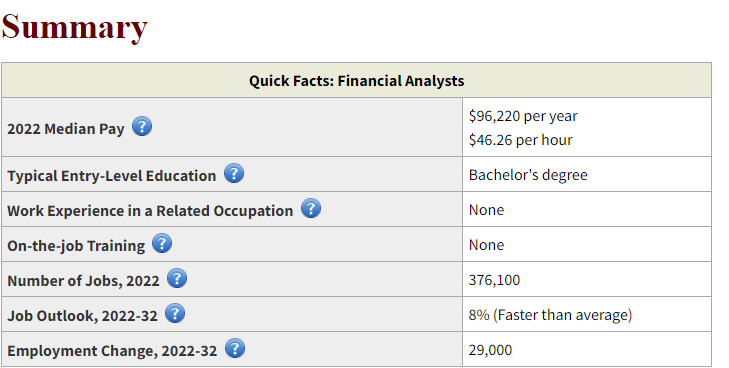

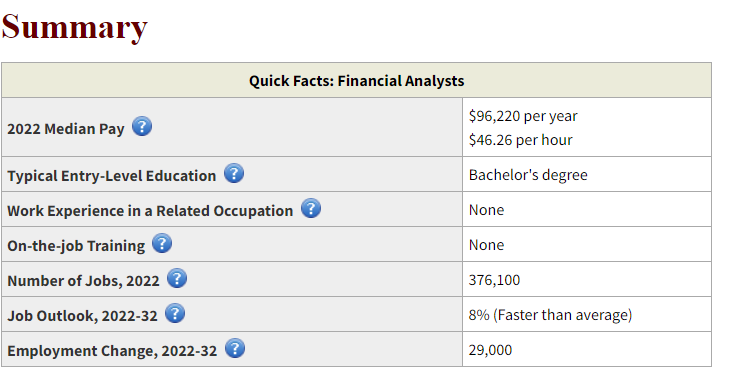

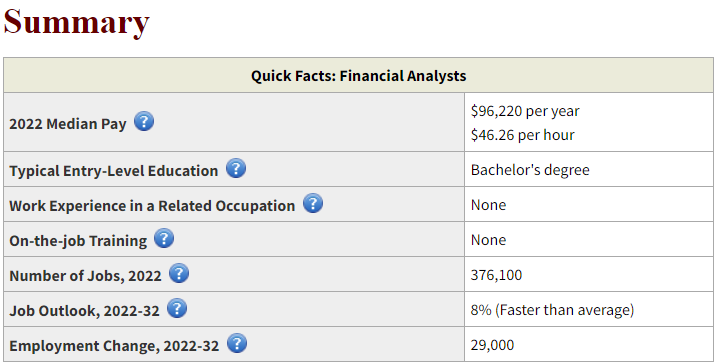

Financial Analyst

Responsibilities: Analyzing financial data, preparing reports, and advising businesses on financial decisions.

Qualifications: Bachelor’s degree in finance, accounting, or related field.

Skills: Analytical skills, mathematical proficiency, attention to detail.

Salary:

Growth:

Accountant

Responsibilities: Managing financial records, preparing tax returns, ensuring compliance.

Qualifications: Bachelor’s degree in accounting or finance.

Skills: Attention to detail, organizational skills, integrity.

Salary:

Growth:

Investment Banker

Responsibilities: Advising clients on financial strategies, managing mergers and acquisitions.

Qualifications: Bachelor’s degree in finance, business, or related field (MBA often preferred).

Skills: Analytical skills, communication skills, attention to detail.

Salary:

Growth:

Fintech Analyst

Responsibilities: Evaluating and implementing financial technologies, analyzing market trends.

Qualifications: Bachelor’s degree in finance, computer science, or related field.

Skills: Tech-savvy, data analysis skills, innovation mindset.

Salary:

Growth:

Impact Investing Analyst

Responsibilities: Assessing investments for both financial return and positive social impact.

Qualifications: Bachelor’s or master’s degree in finance, economics, or related field.

Skills: Analytical skills, understanding of social and environmental issues.

Salary:

Growth:

Risk Manager

Responsibilities: Identifying and mitigating potential risks to a company’s financial well-being.

Qualifications: Bachelor’s degree in finance, risk management, or related field.

Skills: Analytical skills, attention to detail, problem-solving.

Salary:

Growth:

Financial Planner

Responsibilities: Assisting individuals with financial goals, including retirement and investment planning.

Qualifications: Bachelor’s degree in finance, business, or related field; often requires certification.

Skills: Communication skills, analytical skills, customer service.

Salary:

Growth:

Credit Analyst

Responsibilities: Evaluating credit data and financial statements to determine risk.

Qualifications: Bachelor’s degree in finance, accounting, or related field.

Skills: Analytical skills, attention to detail, decision-making.

Salary:

Growth:

Corporate Finance Analyst

Responsibilities: Analyzing financial data, supporting decision-making within a corporation.

Qualifications: Bachelor’s degree in finance, accounting, or related field.

Skills: Financial modeling, data analysis, communication skills.

Salary:

Growth:

Real Estate Analyst

Responsibilities: Analyzing property values, market trends, and potential investments.

Qualifications: Bachelor’s degree in finance, business, or related field.

Skills: Analytical skills, attention to detail, knowledge of real estate markets.

Salary:

Growth:

Deep Dive: Top Emerging Careers in Finance

Delving into the dynamic landscape of finance reveals a spectrum of emerging careers steering the industry into the future. Here’s a deep dive into the top five emerging finance careers:

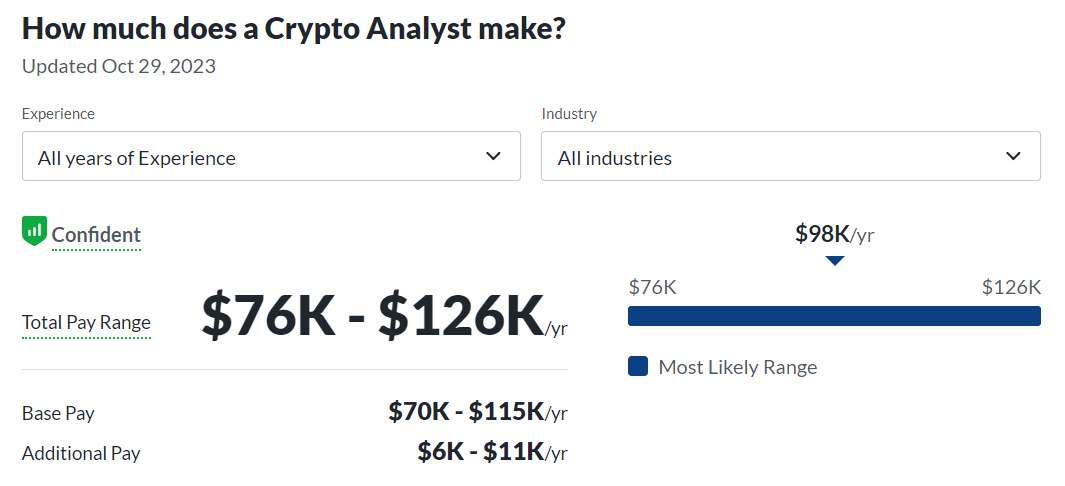

Cryptocurrency Analyst

Role: Analyzing trends and market dynamics in the cryptocurrency space.

Qualifications: Background in finance, economics, or computer science.

Rapid Growth: Fueled by the expanding influence of cryptocurrencies, leading to increased demand for experts in this field.

Salary:

Growth:

N/A IN BLS

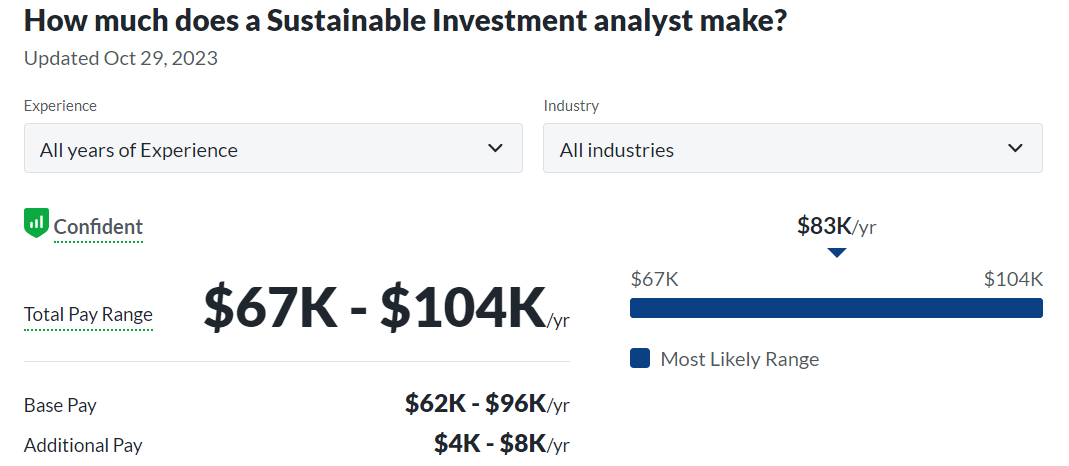

Sustainable Finance Specialist

Role: Integrating environmental, social, and governance (ESG) factors into financial decision-making.

Qualifications: Strong finance background with a focus on sustainability.

Rapid Growth: Reflects the global shift towards sustainable and responsible investing.

Salary:

Growth:

N/A IN BLS

Fintech Analyst

Role: Assessing the impact of technology on financial services and identifying innovative solutions.

Qualifications: Blend of finance and technology-related skills.

Rapid Growth: Driven by the ongoing digital transformation in the financial industry.

Salary:

Growth:

Risk Management Consultant

Role: Advising organizations on identifying and mitigating various risks.

Qualifications: Extensive knowledge of risk management practices.

Rapid Growth: With an increasingly complex business environment, the need for risk management expertise is on the rise.

Salary:

Growth:

Robo-Advisory Specialist

Role: Managing and optimizing automated investment platforms.

Qualifications: Background in finance, often coupled with programming skills.

Rapid Growth: Reflects the growing popularity of robo-advisors and automated investment strategies.

Salary:

Growth:

These emerging roles underline the evolving nature of this field, blending traditional expertise with technological advancements and evolving societal priorities. As the financial landscape continues to transform, professionals in these domains find themselves at the forefront of innovation and change.

Skills for Success in Finance

In the dynamic realm of finance, success hinges on a combination of hard and soft skills. Hard skills like quantitative analysis, financial modeling, and data interpretation are essential for making sound financial decisions.

Soft skills, including communication, critical thinking, and adaptability, foster effective collaboration and leadership. Developing these skills involves a mix of formal education, practical experience, and continuous learning. For instance, aspiring professionals can enhance their analytical skills through coursework and apply them in real-world scenarios via internships. Effective communication skills, crucial for conveying complex financial insights, can be honed through presentations and written reports.

These skills form the bedrock for a successful career. A professional proficient in data analysis can discern market trends, enabling strategic decision-making. Strong communication skills facilitate the clear articulation of financial strategies to diverse stakeholders. Adaptability ensures resilience in the face of industry changes.

Continuous learning keeps professionals abreast of evolving financial landscapes. Mastering these skills equips finance professionals not only with technical prowess but also with the interpersonal finesse required for navigating the complex world of finance, propelling them toward enduring success.

Navigating the Finance Job Market

Navigating the job market demands strategic acumen and proactive networking. Job seekers should tailor their resumes to highlight relevant skills and experiences, making them stand out to potential employers. Establishing a robust online presence on professional platforms like LinkedIn can expand networking opportunities.

Joining finance-related professional associations provides access to industry events and connections. Informational interviews with seasoned professionals offer valuable insights and potentially open doors to job opportunities. Networking, often underestimated, is pivotal in the finance sector where personal connections can lead to job referrals.

Aspiring professionals should attend industry conferences, workshops, and seminars to broaden their knowledge and network. Engaging with professionals in the field helps in staying updated on industry trends and job openings.

An active online presence also signals a candidate’s interest and commitment to the field. Finance is a relationship-driven industry, and the connections made early in one’s career can profoundly influence future opportunities. In the competitive finance job market, strategic networking and active involvement in professional communities can significantly enhance a candidate’s prospects.

Challenges in Finance Careers

Navigating a career in finance can be rewarding, but it comes with its share of challenges. Here’s a detailed exploration of some of the most common challenges:

High Pressure and Fast Pace:

Explanation: Professionals often work in high-pressure environments where quick decision-making is crucial.

Overcoming Strategy: Developing effective time management and decision-making strategies is key. Continuous learning helps in staying ahead.

Work-Life Balance Struggles:

Explanation: Long hours and demanding workloads can make maintaining a healthy work-life balance challenging.

Overcoming Strategy: Setting boundaries, prioritizing tasks, and taking breaks are essential for maintaining balance.

Economic Uncertainty:

Explanation: This field is highly influenced by economic conditions, and uncertainties can impact decision-making.

Overcoming Strategy: Building resilience and adapting strategies to different economic scenarios is essential.

Regulatory Changes and Compliance:

Explanation: The financial industry is subject to frequent regulatory changes, and adherence to compliance is crucial.

Overcoming Strategy: Staying informed about regulatory updates and investing in continuous education is necessary.

Risk Management Challenges:

Explanation: Assessing and managing risks is a fundamental part of this field, but it comes with complexities.

Overcoming Strategy: Developing robust risk management strategies and leveraging technology for analysis.

Technological Disruptions:

Explanation: This sector is evolving with technological advancements, and adapting to these changes can be a challenge.

Overcoming Strategy: Embracing continuous learning, staying tech-savvy, and adapting to new tools and platforms.

Ethical Dilemmas:

Explanation: Making ethical decisions in this field can be challenging, especially when financial interests clash with ethical considerations.

Overcoming Strategy: Developing a strong ethical framework, seeking guidance, and prioritizing integrity in decision-making.

Global Economic Dynamics:

Explanation: Global economic interdependence adds complexity to financial decisions.

Overcoming Strategy: Understanding global economic trends, diversifying strategies, and adapting to international dynamics.

Client Relations and Communication:

Explanation: Effectively communicating financial concepts to clients and stakeholders can be challenging.

Overcoming Strategy: Developing strong communication skills, using clear language, and focusing on client education.

Continuous Learning Requirements:

Explanation: The financial landscape is ever-changing, requiring professionals to engage in continuous learning.

Overcoming Strategy: Embracing a mindset of continuous improvement, pursuing relevant certifications, and staying informed.

Addressing these challenges requires a combination of technical expertise, adaptability, and a commitment to ongoing personal and professional development.

Reaching Success through Finance

Success in this field transcends the mere accumulation of wealth. It involves a deep understanding of economic principles, market dynamics, and a commitment to ethical practices. Encouraging aspiring professionals to pursue a degree involves emphasizing the breadth of opportunities within the field.

From managing investments to shaping financial policies, the impact of this field extends to various sectors. The dynamic nature of this field allows for continuous growth and adaptation, making it a field where success is marked not just by financial gains but by the profound influence one can exert on the global economic landscape. Pursuing this major is, therefore, not just a career choice; it’s a journey towards comprehensive personal and professional development.

Frequently Asked Questions

Is finance or accounting better?

Finance and accounting serve distinct purposes. Accounting focuses on recording financial transactions, while finance deals with broader aspects like investment, risk management, and financial planning. The choice depends on career interests.

I made a video about this. You can watch it here for a more comprehensive analysis:

How do you stand out with a finance major?

Standing out with a finance major involves showcasing practical skills, relevant internships, and certifications. Networking, staying updated on industry trends, and highlighting achievements contribute to visibility.

What do they ask in a finance interview?

Finance interviews may cover technical concepts, problem-solving scenarios, and behavioral questions. Preparation should include a solid understanding of financial principles and effective communication skills

What are the basic concepts of finance?

Basic finance concepts include time value of money, risk and return, diversification, and financial markets. These form the foundation for more advanced financial decision-making.

Is there a future for finance?

The future of finance remains robust, with evolving roles due to technological advancements and global economic shifts. Continuous learning and adaptability will be essential for success.

So, is a finance degree a good major?

… [Trackback]

[…] Read More on to that Topic: shanehummus.com/college-degrees/finance-major/ […]

… [Trackback]

[…] Find More Info here on that Topic: shanehummus.com/college-degrees/finance-major/ […]